Since most people do many things online today, service providers should consider all possible channels for customer engagement. Moreover, it makes sense because different target users prefer different means of reaching the providers. Thus, the latter choose many customer communication sources by adopting an omnichannel strategy.

Banking, retail, and many other industries follow the omnichannel approach to CX, but in this article, we will focus on the insurance sector, where the demand for innovative digital customer experience is very high. You will learn omnichannel CX’s capabilities and how to gain it most efficiently.

The importance of omnichannel CX for insurance

An omnichannel customer experience is an effective approach to gaining a unified view of customer interactions in various communication channels (mobile application, website, chatbot, for instance). It allows insurance businesses to capture and organize customer data (demographics, claims, policies, quotes, etc.) accurately for reporting and analytics.

The quality of customer experience an insurance company offers reflects the extent of their client centricity. Thus, choosing an omnichannel approach shows how eager the company is to serve customers in the most personalized way.

So, the goal of unifying all existing communication channels into a single system is to achieve fail-proof, uninterrupted customer communications while boosting the quality and productivity of all interactions taking place. The ultimate benefits are obvious and long-term — consistent CX brings regular sales and higher revenue, whereas your target audience remains satisfied.

Learn more about insurance digital channels.

Omnichannel CX vs. multichannel CX

Often, businesses confuse “multi” and “omni,” so these should be distinguished since many insurance providers have already adopted a multichannel strategy while not everyone’s gone omni yet.

Multichannel approach is about a service provider connecting with customers through many supported channels. For example, an insurance company may underwrite clients, issue policies, and manage claims via a chatbot or a mobile app.

Omnichannel is all about a provider not only supporting the same range of different customer channels but also keeping all these channels consolidated and centralized, merging all communications into a single system for seamless CX.

In both cases, it is up to the end-user to decide via which channel to contact your company. The difference is in the flexibility and freedom of choice a person gets once they contact the provider. An omnichannel-enabled provider lets customers jump freely across different channels and get the same CX.

But there’s more when it comes to regarding the advantages of omni over multi.

Related article:

How to transform your business with expert digital transformation consulting

The main problems with multichannel experiences

Many providers may not realize it, but we cannot downplay that purely multichannel strategies give rise to “scattered customer service.” When different communication channels live their own lives, the service is all over the place. And one annoying redirection is enough to put off a lot of customers.

Furthermore, companies gain disparate CX data, getting an incomplete picture of business processes and experiencing more issues, including the following:

- Chaotic CX in different channels

- Higher operational expenses

- Cumbersome transitions between channels that interrupt the customer journey

- Disparate data makes poor input for business analytics

- Complicated insurance product adding/changing functionality

- Complex and expensive development and support of multiple APIs

Using omnichannel solutions in insurance helps handle all of the above while simultaneously getting more personalized and seamless CX. But where to start, and which exact tools, features, and aspects must you consider?

Mutual characteristics a mobile app and a website should have to ensure omnichannel CX

To deliver seamless CX, your customer engagement channels (like mobile app, website, or chatbot) should have the following things in common:

- Service purchase business processes

- User journey

- CX, branding, and design

- Analytics

- Tools for adding/changing insurance products

- Server APIs

The channels you are working with are very similar at their core, and you should keep them that way to avoid confusion. Yet it is equally important to introduce a proper volume of differences, which are minimal.

For instance, if we take your regular website and a mobile app, all they differ in are the following:

- Minor design aspects — these include apparent technical and visual specifics of software for the web, mobile, and other platforms.

- Amount of content — websites usually provide more content which is also more detailed and SEO-optimized.

All the rest (listed above) should be kept unified and defined by common corporate and design attributes. A pro tip here would be to perceive all solutions you offer for customers as one consistent system rather than a set of separate projects.

How to implement an omnichannel strategy in practice? Let’s look at each aspect in more detail and take it step by step.

Read our article on how to create a chatbot for insurance industry

Setting up an omnichannel CX step by step

There are many essential elements underlying your omnichannel undertaking, and their number can increase based on how many channels you want to cover. All channels must offer the same set of services and range of functionality (with slightly expanded options in certain cases). But they all need to be unified into one solution.

Here at DICEUS, we also recommend our insurance customers choose one central channel. And the best option for today is a mobile app, as it provides some capabilities your website can’t (push notifications, for instance).

Main mobile app

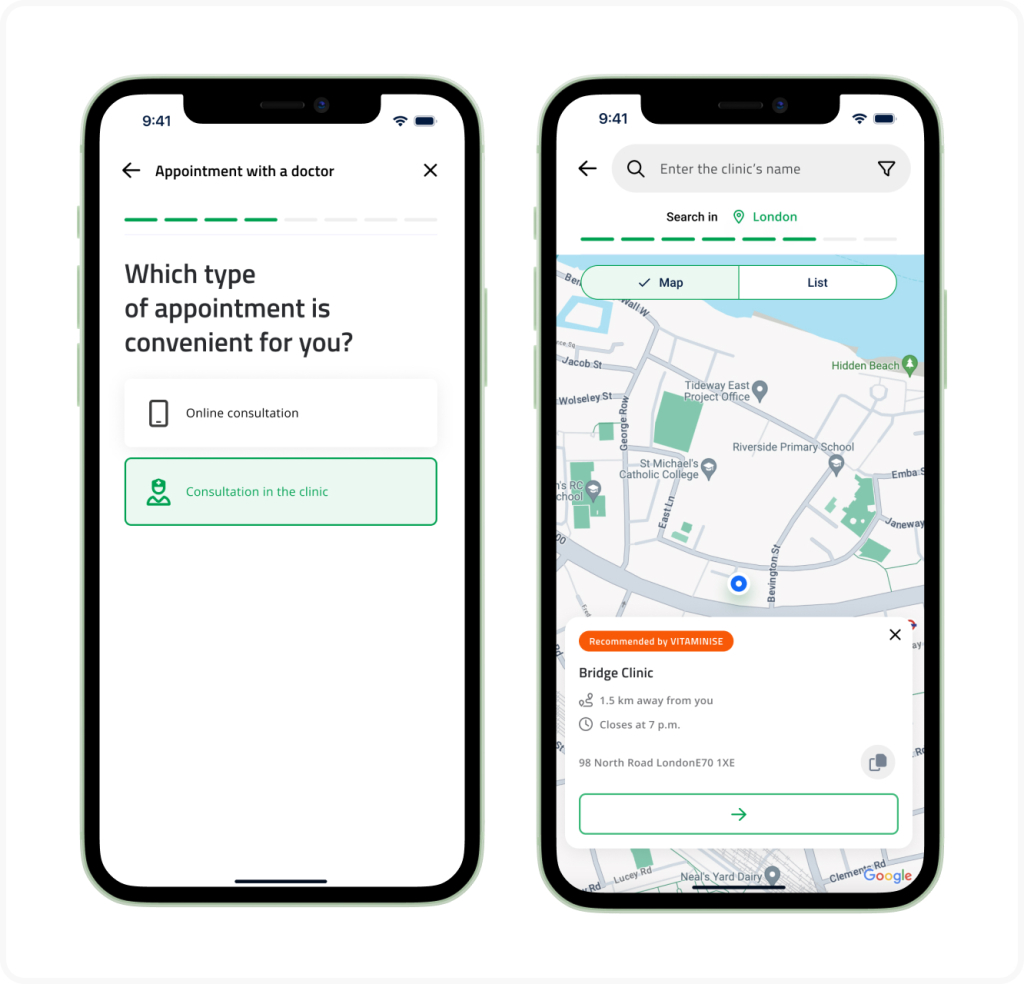

A mobile service app is your main channel of customer communication. Simply because this format has long proven to be the most accessible, convenient, and demanded among users. A good app will help you gather people in one handy place.

With a high-quality app as your main channel, you can achieve the following benefits:

- Customers get the fastest access to their documents anytime.

- Push notifications keep customers more engaged.

- The workload at your call center will be decreased.

Your ultimate task is to keep everybody satisfied and use other channels to attract more traffic. You should motivate users from those channels to switch to the app. The main channel must offer the most value and be the central service hub.

You might be interested in the following articles:

How insurance companies can improve customer experience with a mobile app

How to gain a competitive advantage in the insurance sector through digital channels

3 digital tools to improve customer engagement for insurance companies

Business processes and customer journey

The processes of the customer’s purchase progress must be identical across all interaction channels. The same number of steps when buying via an app, a website, or a chatbot. The same payment and delivery options.

Here’s what a well-tried algorithm for achieving CX consistency looks like:

- A customer purchases insurance on the website.

- They get an incentive to download the app afterward.

- The app offers a policy, personal insurance history, and customer support in one place.

- The app also allows one to automate insurance policy prolongation and purchase other insurance products for oneself or one’s relatives.

Keep every customer journey consistent and seamless by providing unified recommendations, directing, and letting customers switch freely between the channels. Thus, a customer who just purchased insurance online can start managing and tracking it more conveniently via an app, where they also get many extra opportunities.

Various scenarios can be planned, but it all must come down to the common goal of leading all customers to the main channel. You can experiment, for instance, with SEO keywords to attract those customers in the first place, as well as with post-purchase notifications.

Depending on the complexity and longevity of the insurance policy, the notifications may vary in activity. You may also adjust the notifications and recommendations based on the general topic of the insurance (health, property, etc.).

CX, branding, and design

Ensure a single dedicated CX specialist handles implementing a unified design system at the core of all connected channels. This will help you keep your branding authentic and consistent. In turn, you get better brand awareness and channel accessibility among customers. Customers will recall all this comfort when buying another insurance service.

The essential elements to consolidate here include:

- CX copy (microcopy) — all the little details, titles, and wordings leading customers along their experience

- General copy — all the statements, descriptions, and other text content that fill up your website, email marketing newsletter, SMM publications, etc.

- The Tone of Voice — the way you deliver announcements and notifications, which may range from cold/warm/neutral corporate to informal to individually friendly

Tools for adding/changing insurance products

Next in line to unify and centralize are the means of adding and changing insurance products that users get turning to your services. Yes, nothing should differ here, too. The big question is how to achieve that in the most reasonable conditions.

Based on our experience, you should either

- create a separate registry of metadata for products and business processes available to different teams responsible for building and testing separate solutions

or

- build a centralized platform where each channel is synchronized and updates personalized data semi-automatically.

This is a very responsible, technical choice where you need professional advice or, better yet, the assistance of experienced field specialists.

Analytics

Next up, the foundation of your business scaling and expansion — data and the way you analyze it. Again, with a well-organized approach, you get powerful analytics and invaluable business insights. To implement it efficiently, you will need the following:

- A consolidated set of metrics for all channels and a unified reporting format

- A C-level dashboard displaying relevant stats on users, customers, revenue, etc.

- An RoI calculator for financial statistics

- A foundation of end-to-end analytics capacities

The latter is essential — your analytical reports must gather data across all digital channels, providing exhaustive summaries on how many users you get and how many of them fill out forms, buy/don’t buy insurance products, etc.

Server APIs

Finally, you need to handle your server connections. For the smoothest results, use the same APIs throughout. Any changes and adjustments would set specialists apart and cause difficulties. The final number of necessary APIs depends on how many vendors are connected to your system. Again, this is the task of an experienced specialist.

The program management approach to building omnichannel CX

A specialized program management framework will help you tie things up, gain better control over the processes, and achieve business goals more efficiently.

Using a program management approach, you set a single program manager to watch over a number of related projects, managing their vision, scope, design, and other essential factors that must be kept consistent with the overall business strategy.

It is the ultimate way to distribute resources and capacities most reasonably. And you don’t need two separate UX specialists to work through user journeys for different channels, which saves tons of time and money in the long run.

DICEUS expertise

As you can see, you can achieve a game-changer omnichannel strategy that is authentic to your specific insurance company. We offer you the tools, experience, and expertise to leverage and maximize those opportunities without going far.

With over thirteen years in the market and 250 seasoned tech professionals onboard, we can make your life easier while enabling market-defining omnichannel solutions. At DICEUS, we offer you the following:

- In-depth knowledge, best practices, and relevant digital insurance trends at the core of your project

- Experience gained implementing 130 successful projects, including some of the Big Four’s consulting projects

- Strong focus on unified insurance solutions and omnichannel customer experience

- Reliable implementation of insurtech products that give more control, stimulate sales, retain customers, and reinforce brand reputation.

Contact us to discuss your omnichannel initiative and turn your insurance company into a digital powerhouse.

FAQ

What is omnichannel customer experience (CX) in the context of the insurance industry?

Omnichannel experience in the insurance industry means gathering and organizing all the available information about customers from multiple communication channels, such as mobile applications, chatbots, and web portals, to gain a 360-degree view of customers for better analytics and data-driven decision-making.

Why is omnichannel CX important for insurance companies?

Omnichannel customer experience in insurance is paramount for building long-lasting customer relationships. This approach to CX helps improve customer loyalty by giving consumers more convenient options of interaction with insurers and eliminating cumbersome and time-consuming steps a customer should traditionally take to contact an insurance company or agency.

What channels are typically involved in omnichannel CX for insurance?

Typically, chatbots, mobile applications, web portals, and social media are the key digital channels involved in establishing an omnichannel strategy for insurance.

Can omnichannel CX improve customer engagement in the insurance industry?

Absolutely, unlike the multichannel approach to CX, the omnichannel approach allows for enhanced customer engagement thanks to the helicopter view of customers. Customer feedback and other important data are gathered in one place, facilitating data-driven upselling and cross-selling marketing strategies. Due to efficient capture of data, sales and marketing departments can also analyze customer behavior and preferences and create personalized offerings.

Сообщение Omnichannel customer experience in the insurance sector появились сначала на DICEUS.